Forms, forms, forms. I bet nobody enjoys them, but some are just too valuable to ignore – Form 5695, for example. This form is your ticket to claiming the solar tax credit, which helps you shave a huge chunk off your tax bill. And the good news? It’s not as complicated as it looks. In this article, I’ll walk you through what a form 5695 is, how to fill it out correctly, and other key details to make sure you claim your credit without any issues.

What is a Form 5695?

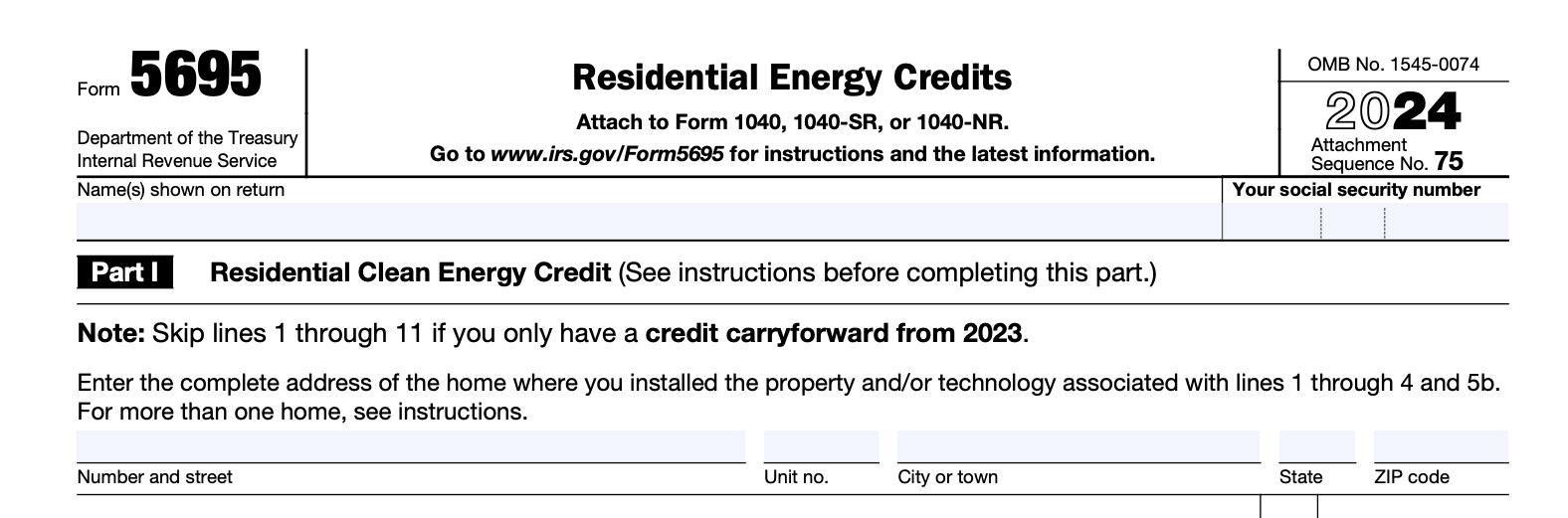

Form 5695 is the IRS tax form used to claim credits for your home solar panel investment. It also applies to other renewable energy upgrades such as solar water heaters, wind turbines, and other home energy efficiency improvements.

And just a bit of refresher: the specific credit you’re claiming here is the Residential Clean Energy Credit.

Unlike a tax deduction, which lowers your taxable income, this credit directly reduces the amount of tax you owe.

There’s no maximum limit on how much you can claim. As of 2025, the credit covers 30% of your total eligible expenses. So, if your solar system costs $20,000, you’d be looking at a $6,000 tax credit.

That being said, the credit won’t stay at 30% forever. In 2033, it drops to 26%, then to 22% in 2034, and disappears entirely in 2035 unless extended by Congress.

Am I Eligible for the Residential Clean Energy Credit?

As great as this credit is, not every homeowner qualifies for it. So before rushing into the paperwork, make sure you meet the conditions first. The IRS provides full details in the Instructions for Form 5695, but I have them simplified for you below:

- The system must be installed in a home you own in the U.S. Rental properties you don’t live in don’t qualify (business-related energy incentives follow different tax rules).

- The system must be placed in service during the tax year you’re filing for (not just purchased).

- Only new installations qualify. Used or secondhand equipment won’t count.

- You must own the solar panels. If you’re leasing them or have a PPA, you’re not eligible.

- You must have a tax liability.

Speaking of tax liability, since the solar tax credit is non-refundable, you won’t get a cash refund from the IRS if you don’t owe taxes.

However, you won’t lose the credit either. Instead, any unused portion carries forward to future tax years, meaning you can apply it against taxes owed in the following years until it’s fully used.

Steps to Fill Out Form 5695 to Claim the Solar Tax Credit (2024)

If you use a tax preparer or accountant, they will handle this form for you. But if you’re filing your own taxes, you’ll need to fill out Form 5695 yourself as part of your tax return. Extra note: The steps I’ve outlined below only apply to solar installations, including solar panel systems and solar batteries. This guide also assumes you don’t have other renewable energy sources, like fuel cells or energy-efficient home improvements.

Step 1: Gather Essential Documents

Before starting Form 5695, gather everything you need for quick and accurate referencing. Here’s what you should have on hand:

- Form 5695

- Receipts for your solar installation, showing the total cost

- Form 1040 (your main income tax return)

- Residential Clean Energy Credit Limit Worksheet (needed to determine how much credit you can use this year)

- Form 1040, Schedule 3 (where you will transfer the final tax credit)

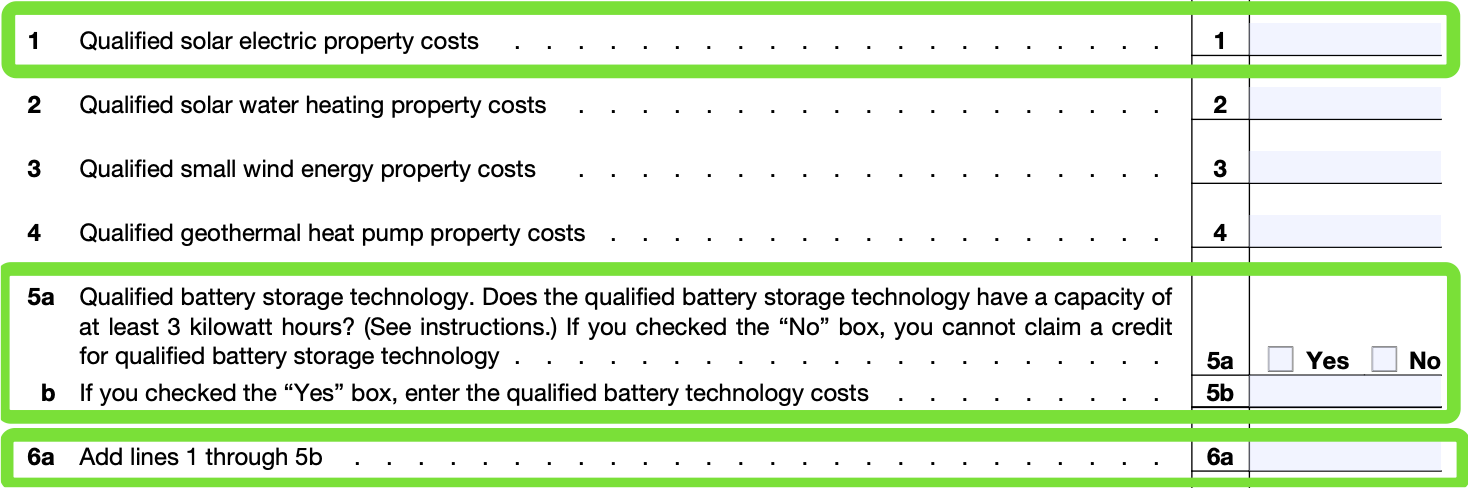

Step 2: Enter the Total Cost of Your Solar System

The IRS bases your tax credit on the total cost of your solar system. Eligible costs typically include solar panels, inverters, and mounting equipment, among other solar system components, as well as labor.

Enter this cost on Line 1 of Form 5695, as well as on Line 6a.

However, if you installed a solar battery (3 kWh or larger), check “Yes” on Line 5a, enter the battery’s cost on Line 5b, and then add Lines 1 and 5b together. This new total should be placed on Line 6a.

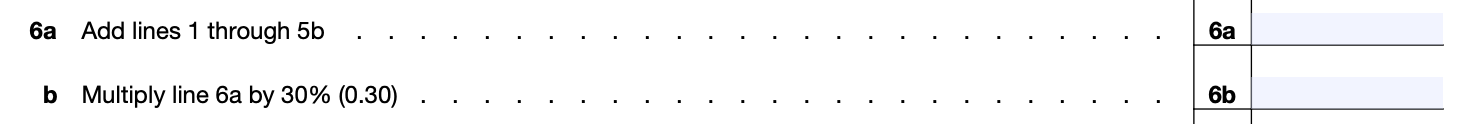

Step 3: Calculate Your Credit Value The Residential Clean Energy Credit equals 30% of your total system cost. To calculate:

- Take the amount from Line 6a and multiply it by 0.30 (30%).

- Enter the result on Line 6b.

For example, if your system cost $20,000, your credit would be: $20,000 × 30% = $6,000

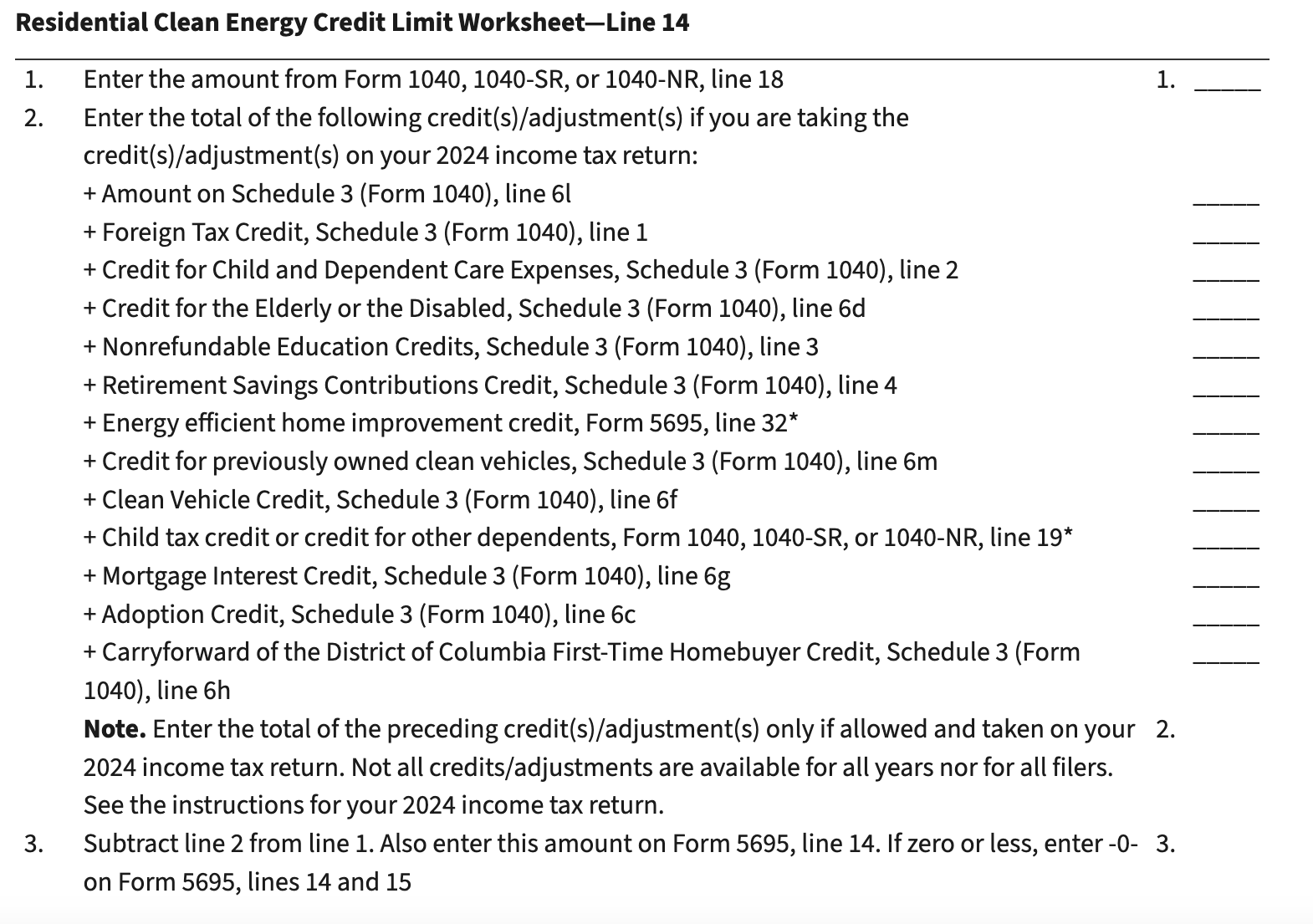

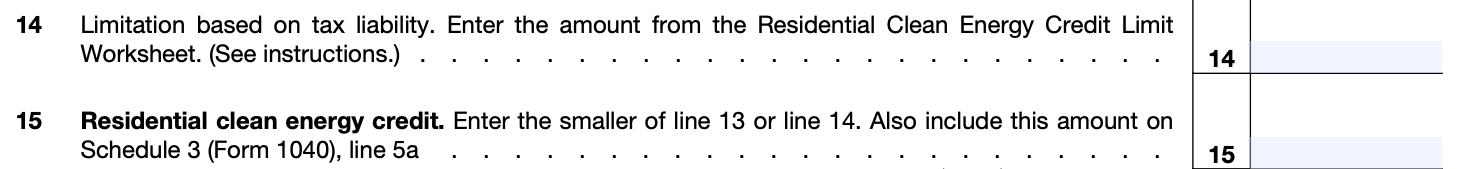

Step 4: Calculate Your Tax Liability & Maximum Claimable Tax Credit

While you may have calculated a 30% solar tax credit, you can only claim up to your total tax liability for the year.

To figure this out, look at Line 18 of your Form 1040 (this is your total federal income tax). Now, using the Residential Clean Energy Credit Limit Worksheet, follow these steps:

- Subtract all refundable tax credits (Worksheet Line 2) from your Form 1040, Line 18 amount (Worksheet Line 1)

- The remaining amount (Worksheet Line 3) is your actual tax liability – this is the maximum credit you can claim this year.

Now, return to Form 5695. Enter your maximum claimable credit on Line 14 (and Line 15)

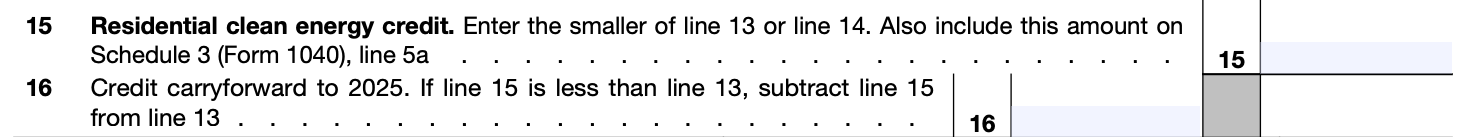

Step 5: Calculate Carry-Over Credit (If Any) If your tax liability (Line 15) is lower than your total credit value (Line 6b), you cannot claim the full credit this year. Instead, you can carry forward the unused portion to next year’s taxes. To do this:

- Subtract Line 15 from Line 6b.

- Enter this amount on Line 16 – this is what you can apply to future tax years.

For example, if your total credit is $6,000 (Line 6b), but your tax liability is only $4,000 (Line 15), you’ll carry forward $2000 to future tax returns.

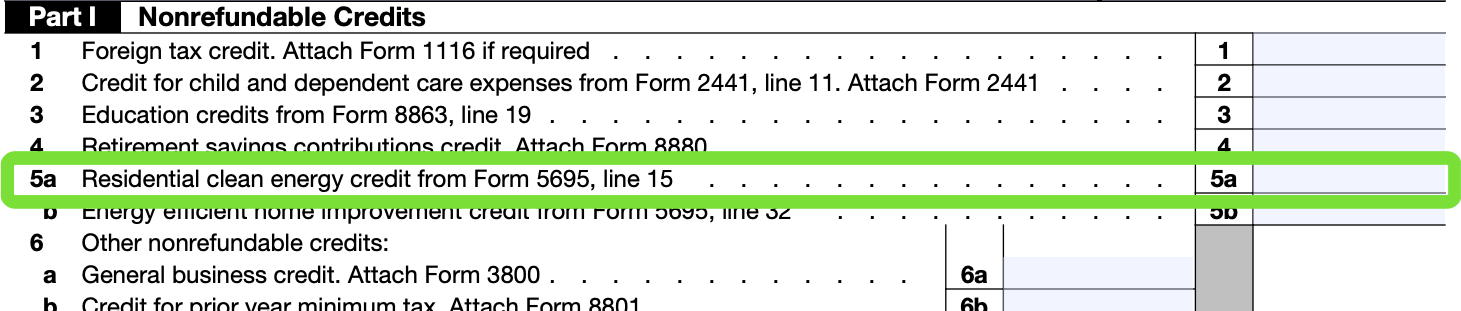

Step 6: Enter Your Claimable Tax Credit credit on Form 1040 Schedule 3

Once you’ve completed Form 5695, the final step is transferring your solar tax credit to your Form 1040, Schedule 3.

Simply, find Schedule 3, Line 5a and enter your credit amount from Form 5695, Line 15.

This ensures your tax credit is applied correctly when filing your return.

When Should I File Form 5659?

You must file Form 5695 with your tax return for the year your solar system was installed and became operational. That said, the purchase date does not matter – what matters is the installation/completion date.

So, if you bought your solar panels in November 2024 but the system was installed and activated in January 2025, you must claim the credit on your 2025 tax return, which is typically filed by April 2026.

If you forget to claim the credit, you can file an amended tax return (Form 1040-X) to correct the mistake and still receive the credit. I recommend you seek tax advice from a professional for the best course of action.

Do I Need to Submit Documentation With Form 5695?

No, you won’t need to submit documentation as the IRS doesn’t require you to attach receipts or proof with your Form 5695. However, I do recommend keeping them in case an IRS audit happens.

Can I Carry a Solar Tax Credit Forward for Future Tax Years?

Yes. If your solar tax credit is larger than what you owe, the IRS lets you carry forward the remaining balance to future tax years.

For example, if you qualify for a $6,000 credit but only owe $3,000 in taxes, you can apply the remaining $3,000 toward next year’s taxes.

This carry forward rule ensures you don’t lose any part of your credit, even if your tax bill is low.

Final Words on Form 5695

Filling out tax forms isn’t exactly exciting, but if it means getting thousands back from your solar investment, it’s definitely worth it. I hope I’ve laid everything out in a way that makes it easy for you to follow and claim your credit successfully.

That said, if you’re ever unsure or have specific concerns, I highly recommend consulting a tax professional.

And if you’re looking for more ways to make the most of solar, head over to the Avail Solar Blog, where my team and I share professional advice, practical tips, and step-by-step guides – all for free.